Free home visits

with a local audiologist

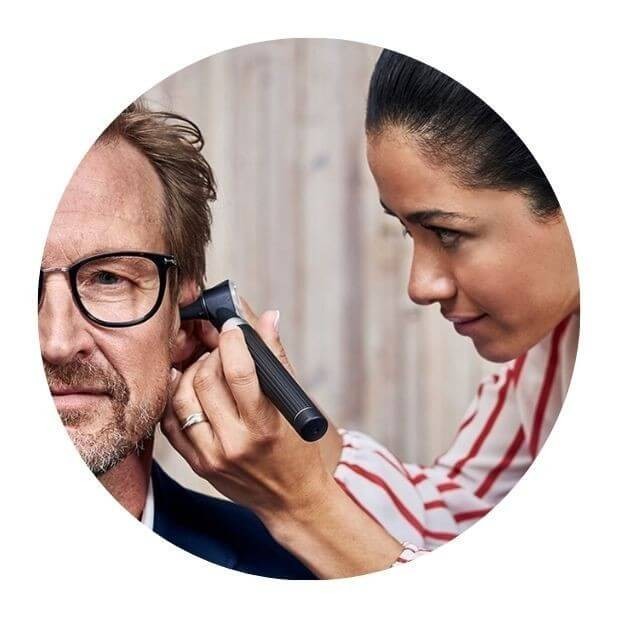

Finding the right solution to hearing loss can be very confusing. If you want impartial, independent advice then you’ve come to the right place. If you are considering purchasing digital hearing aids then please compare our services.

Impartiality: We are not owned by or associated with any manufacturer. When our audiologists recommend a hearing aid it’s because it’s the best hearing aid for you.

Professionalism: All our audiologists are fully qualified and registered with the HCPC (Health and Care Professions Council). Our telephones are manned by audiologists so we are able to provide expert advice instantly.

We deal with all manufacturers so we are able to offer every digital hearing aid on the market and the best hearing aids available.

Price: Our hearing aid prices are amongst the lowest you will find anywhere in the world.

Service: All our prices include all testing, fitting, and aftercare for life. There are no hidden extras.

Coverage: We have over 200 independent audiologists who cover the whole of the UK and Ireland. They operate from shops, clinics, day centres and also provide a free home visit service.

Like most national hearing aid companies, around half of our service is provided in a branch and half by way of a home visit.

Recommendation: Which? the consumer watchdog has conducted three surveys over the last ten years to evaluate the right place to purchase the best hearing aids. On all of the surveys, the “independent audiologist” came top in all categories measured.

In the years 2018 to 2019, 2 out of the 10 national hearing aid retailers went into administration. This includes Age UK Hearing (also known as Claritas).

We are a network of independent audiologists and have several audiologists in every area. This means we can look after your hearing healthcare needs locally.

We can give you security. In the unlikely event of any one of them ceasing to operate for whatever reason then your service would continue with one of our other audiologists at no cost to yourself.

Compatibility: Looking for hearing aids that work with an iPhone or Android mobile phone? Maybe you have NHS hearing aids and want to upgrade to advanced Bluetooth connectivity.

Do not spend hundreds of pounds without getting a second opinion from us.

Not only are the prices great, but the service is fantastic! Many thanks to your team.

Not only are the prices great, but the service is fantastic! Many thanks to your team.

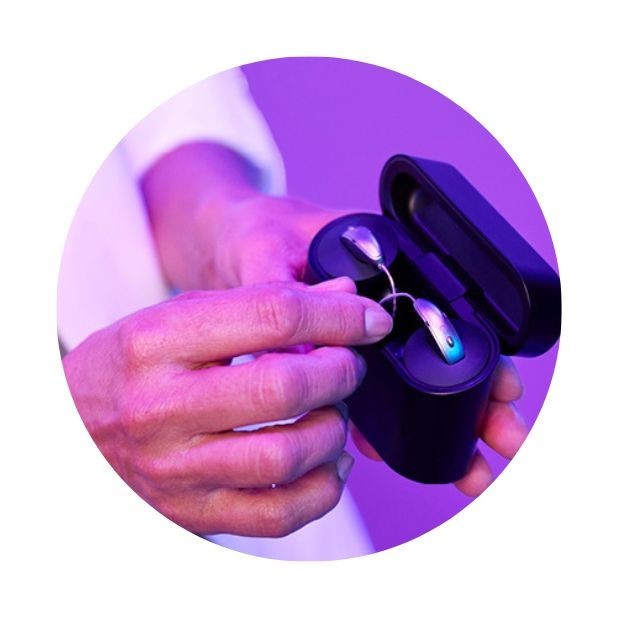

Book a free hearing test and explore all the award-winning hearing aid brands we work with. We have changed over 31,000 people's quality of life by helping them to simply hear better.

We know how complex it is to find the right hearing solution, but it all starts with finding the right audiologist in your area who you can trust. We can help you do that.

Book a free hearing test either in a clinic local to you or in the comfort of your own home for no additional charge and take the first steps to hear better.

With over 200 independent audiologists nationwide - wherever you live, we generally have two or three audiologists in your area. To find out where your nearest one is, complete the contact form further down the page.

All our hearing aid audiologists can provide you with home visits if that is more convenient for you. We don't charge you for this service, unlike some companies.

There are many benefits to be enjoyed by having the luxury of a home service and impartial advice across all the hearing aids on offer.

Hearing Aid Dispensers are regulated by the Health and Care Professions Council (HCPC) set up to protect the public. They keep a Register of health and care professionals who meet their standards for their training, professional skills, behaviour ,and health.

Are the professional body that represents and promotes the interests of the independent hearing aid profession across the UK.

Members are highly trained hearing care professionals who have extensive and unrivalled experience and knowledge of the hearing instruments that are available to help with hearing loss.

Hearing Aid UK Owner, Paul Harrison was on the BSHAA Council between 2015-2020.

When we refer to a product as 'Latest Launch', we mean it is the latest to be released on the market.

When we refer to a product as 'New', we mean that the product is the newest hearing aid model on the market.

When we refer to a product as 'Superseded', we mean that there is a newer range available which replaces and improves on this product.

When we refer to a product as an 'Older Model', we mean that it is has been superseded by at least two more recent hearing aid ranges.